Category: Ethics

Conservative Radio Host Says Bondi ‘Should Be Fired or Resign’ After House Hearing Flub

Erick Erickson said Pam Bondi should quit or be fired after she said citizens should be more focused on the stock market “smashing records” than Jeffrey Epstein

The post Conservative Radio Host Says Bondi ‘Should Be Fired or Resign’ After House Hearing Flub first appeared on Mediaite.

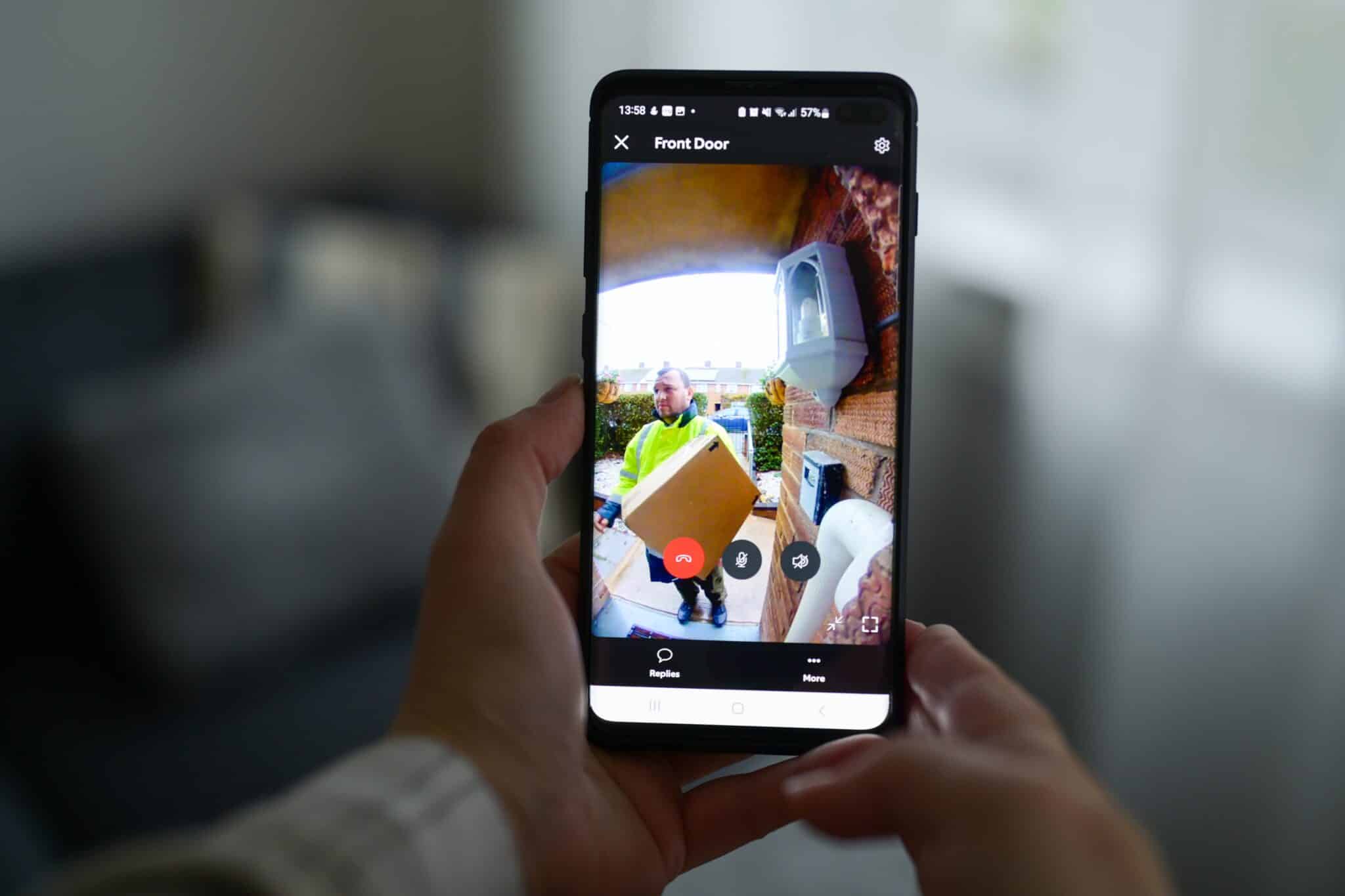

Ring Super Bowl ad sparks backlash over AI camera surveillance

A Super Bowl commercial for Amazon’s Ring doorbell camera triggered swift backlash, with critics arguing that the company used an emotional story about a lost dog to promote a neighborhood scale camera network while minimizing the broader privacy and civil liberties implications of searchable AI video.

The short commercial which was intended to highlight lost pet reunions instead ignited a broader national conversation about how much machine vision society is willing to accept in exchange for safety and convenience.

The ad highlighted Ring’s Search Party feature, which is designed to help reunite owners with lost dogs by using AI to scan video from nearby participating cameras for potential matches.

In the commercial, a missing pet is located through coordinated alerts across a network of doorbell and outdoor cameras. But what Ring framed as a story of community assistance was viewed by many privacy advocates as a normalization of ambient surveillance infrastructure.

Civil liberties groups said the ad blurred the line between voluntary home security and de facto neighborhood monitoring. They warned that packaging AI powered video search as a feel-good service during one of the most watched television events of the year risks desensitizing viewers to how such systems function at scale.

The Electronic Frontier Foundation (EFF) issued one of the strongest responses. “Amazon Ring’s Super Bowl ad offered a vision of our streets that should leave every person unsettled about the company’s goals for disintegrating our privacy in public,” the organization said.

EFF added that the commercial, “disguised as a heartfelt effort to reunite the lost dogs of the country with their innocent owners, previewed future surveillance of our streets, a world where biometric identification could be unleashed from consumer devices to identify, track, and locate anything, human, pet, and otherwise.”

Sen. Ed Markey, a longtime critic of consumer surveillance technologies, also condemned the ad. He said Ring is “turning your neighborhood into a surveillance network,” and warned that tools marketed as community safety features can “create serious risks for privacy and civil liberties.”

In prior oversight letters examining Ring’s practices, Markey has argued that “Americans should not have to trade their privacy for security.”

Search Party allows users to create a lost dog post within the Ring app and activate AI scanning among participating nearby cameras. The system analyzes footage for potential matches based on characteristics such as size, breed, and markings.

If a possible match is detected, the camera owner receives a notification and can choose whether to share the clip. Ring has described the feature as voluntary and time limited, emphasizing that no footage is automatically sent to the pet owner without user approval.

Company executives have pointed to early reunions as evidence that the feature works and say it simply streamlines what neighbors already do when they share lost pet posts through social media and community forums.

Supporters argue that participation is optional and that users retain control over their own footage.

Critics counter that the backlash is not about dogs but about infrastructure. They argue that a distributed network of privately owned cameras equipped with AI search capabilities normalizes constant monitoring.

Even if the feature is limited to pets, they say the technical foundation resembles systems used for object recognition and biometric identification. In that context, the difference between identifying a dog and identifying a person becomes a question of software configuration rather than hardware capability.

Another flashpoint involves default participation. During rollout, the feature was enabled by default on certain compatible devices, requiring users to opt out if they did not want their cameras to participate.

Privacy advocates argue that default settings shape real world surveillance reach because many users do not regularly review device configurations. They contend that opt out architecture can quietly scale a searchable network across entire neighborhoods.

The Super Bowl ad also aired amid broader debate over Ring’s expanding AI features, including tools that allow users to identify familiar faces and receive personalized alerts.

Last October, Markey sent a letter to Amazon CEO Andrew Jassy in which warned that the company’s new Familiar Faces feature represents a dangerous step toward normalizing mass surveillance in American neighborhoods.

Markey described the rollout as “a dramatic expansion of surveillance technology” that poses “vast new privacy and civil liberties risks,” arguing that ordinary people should not have to fear being tracked or recorded when walking past a home equipped with a Ring camera.

While the Search Party feature is not marketed as a facial recognition system, critics argue that the same classification infrastructure underpins both types of capabilities and makes future expansion easier.

Concerns about law enforcement access resurfaced as well. Ring previously ended a program that facilitated direct police requests for footage through its app, but it continues to operate community request tools that allow public safety agencies to ask nearby users to voluntarily share video tied to investigations.

Those requests are integrated into platforms used by public safety technology vendors, including Flock Safety, which operates automated license plate reader networks.

Privacy advocates argue that once footage is shared with local agencies, it can be retained, combined with other datasets, or disseminated further in ways that are difficult for individual users to track.

Even if Ring does not provide direct backend access to federal agencies, they say downstream sharing arrangements create uncertainty about how footage ultimately circulates.

Some social media speculation during the controversy claimed that federal immigration authorities could directly access Ring cameras. Ring has denied giving Immigration and Customs Enforcement direct access to its video feeds or systems.

Civil liberties groups maintain that the broader concern is structural rather than agency specific. Once a searchable neighborhood camera network exists, they argue, questions of governance and oversight extend beyond any single policy assurance.

At the center of the debate is a larger cultural tension. The Super Bowl ad presented AI driven monitoring as reassuring and community minded. Critics say that framing risks redefining constant observation as a civic virtue. Supporters say the feature represents practical innovation that helps solve everyday problems.

The episode illustrates how rapidly consumer camera technology is converging with capabilities once associated primarily with state surveillance. As AI makes video archives searchable and classifiable at scale, the boundary between smart home convenience and neighborhood intelligence infrastructure continues to narrow.

Anti-Israel Conservative Activist Ousted From White House Religious Liberty Commission Over Behavior

Carrie Prejean Boller, a conservative activist appointed to the White House Religious Liberty Commission during the Trump administration, was removed…

Free Tool Says it Can Bypass Discord’s Age Verification Check With a 3D Model

The tool presents users with a 3D model they can then manipulate to, the creator says, bypass Discord’s age verification system.

With Ring, American Consumers Built a Surveillance Dragnet

Ring’s ‘Search Party’ is dystopian surveillance accelerationism.